deferred sales trust pros and cons

The strength of the deferred sales trust is its flexibility and relatives all pressure to purchase a property via a short time frame using a 1031 exchange. Pros And Cons Of Deferred Sales Trust posted Jan 7 2019 1034 PM by David Leiker updated Jan 7 2019 1034 PM by David Leiker updated.

An Opportunity To Save On Income Taxes Bny Mellon Wealth Management

Reef Point was established as one of the few authorized Trustees in the US to create Deferred Sales Trusts a shrewd and legal way to defer capital gains tax and reduce the overall tax.

. And finally your right to receive the money. Most of the clients also choose a lower. We will explore why so many high net worth individuals are leveraging.

Deferred Sales Trust Pros and Cons. 1031 exchange vs Deferred Sales Trust Part 6- Depreciation Schedule AdvantageAre you interested in becoming a deferred sales trust expert. Pros And Cons Of Deferred Sales Trust posted Jan 7 2019 1034 PM by David Leiker updated Jan 7 2019 1034 PM by David Leiker updated.

The primary benefit of deferred sales trusts is the. This is an introdu. The deferred option provides a 6000 interest-free loan that is.

This is an introduction to the deferred sales trust and how it compares to the 1031 exchange. In this video were going to take a look at the pros and cons of deferral sales trust. Reef Point was established as one of the few authorized Trustees in the US to create Deferred Sales Trusts a shrewd and legal way to defer capital gains tax and reduce the overall tax.

A deferred payment agreement is a long-term loan you can request from your local authority if you own your home. Are you interested in becoming a deferred sales trust expert. Are you interested in becoming a deferred sales trust expert.

Let us conclude by discussing some of the pros and cons of deferred sales trusts. Most of the clients also choose a lower. Today I am going to talk about The Pros and Cons of the Deferred Sales Trust with Jake and GinoJoin Our No-Cost Deferred Sales Trust Mastermind every Frida.

Are you interested in becoming a deferred sales trust expert. This is an introduction to the deferred sales trust and how it compares to the 1031 exchange. This is an introduction to the deferred sales trust and how it compares to the 1031 exchange.

Deferred Sales Trust Pros Cons. Fees to structure the Deferred Sales Trust are often much higher than other income tax planning strategies such as a 1031 exchange. If you are considering the sale of investment real estate a business or other highly-appreciated assets you may face capital gains taxes as a.

The Pros And Cons Of Opportunity Zone Funds For The Passive Investor

Employee Ownership Trusts The Pros And Cons

Life Insurance Vs Annuity How To Choose What S Right For You

Advanced Planning Deferred Sales Trusts The Quantum Group

Delaware Statutory Trusts A Comprehensive Guide With Pros And Cons

Deferred Sales Trust 101 A Complete Guide 1031gateway

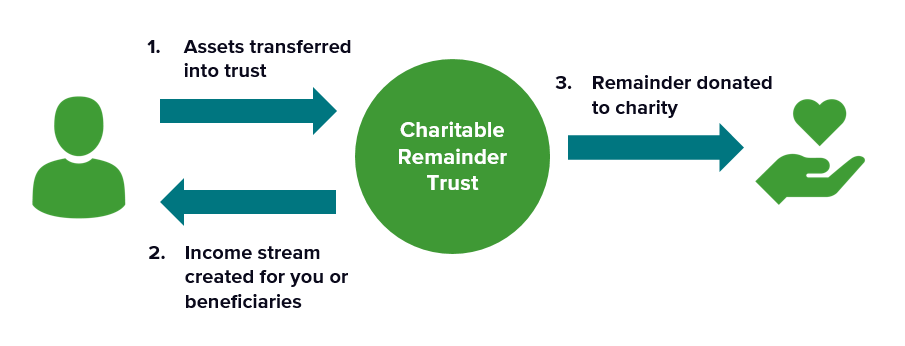

How To Generate Income In Retirement With Charitable Remainder Trusts

:max_bytes(150000):strip_icc()/TermDefinitions_Template_promissorynote.asp-7eb6fa7f932548a08fbd2533e3c5aef7.jpg)

Promissory Note What It Is Different Types And Pros And Cons

1031 Exchange Alternative Capital Gains Tax On Real Estate

Top Ten Estate Planning And Estate Tax Developments Of 2021 The American College Of Trust And Estate Counsel

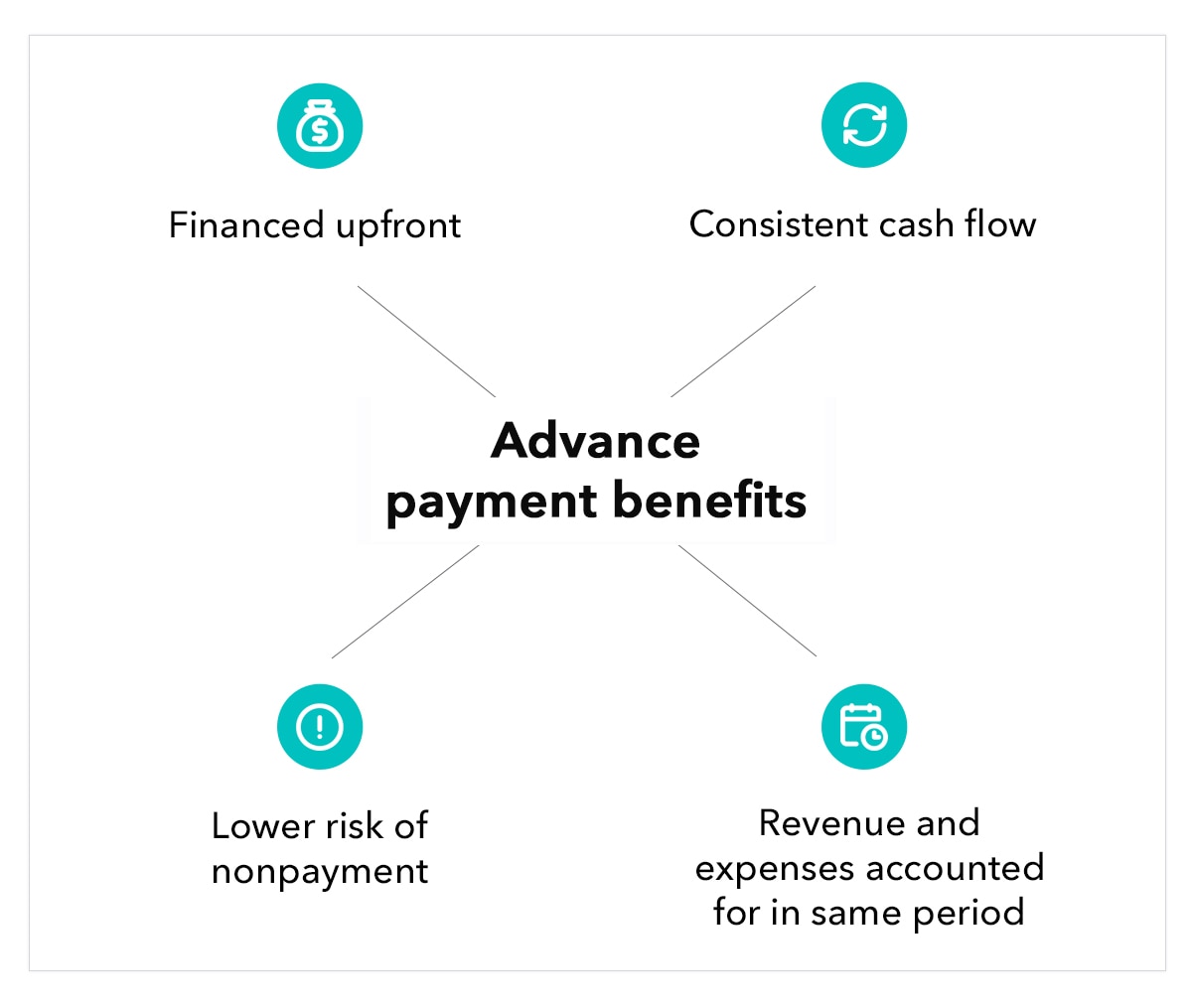

Accepting Advance Payments What Is Advance Billing Article

Tax Considerations When Selling Your Business Bessemer Trust

Restricted Property Trust A Pro Con White Coat Investor

The Pros And Cons Of Opportunity Zone Funds For The Passive Investor

![]()

Deferred Sales Trust Pros Cons

Advanced Planning Deferred Sales Trusts The Quantum Group

What Is A Deferred Sales Trust